Habitat for Humanity of St. Charles County (HFHSCC) is continuing to address the ever-increasing need for affordable housing in our community, as well as the need for improved health and education of our hardworking homeowner partners and their children. Since our founding in 1997, HFHSCC has completed 97 homes with the generous contribution of many members of the community, both as donors and volunteers.

HOW TO OBTAIN AN AHAP TAX CREDIT

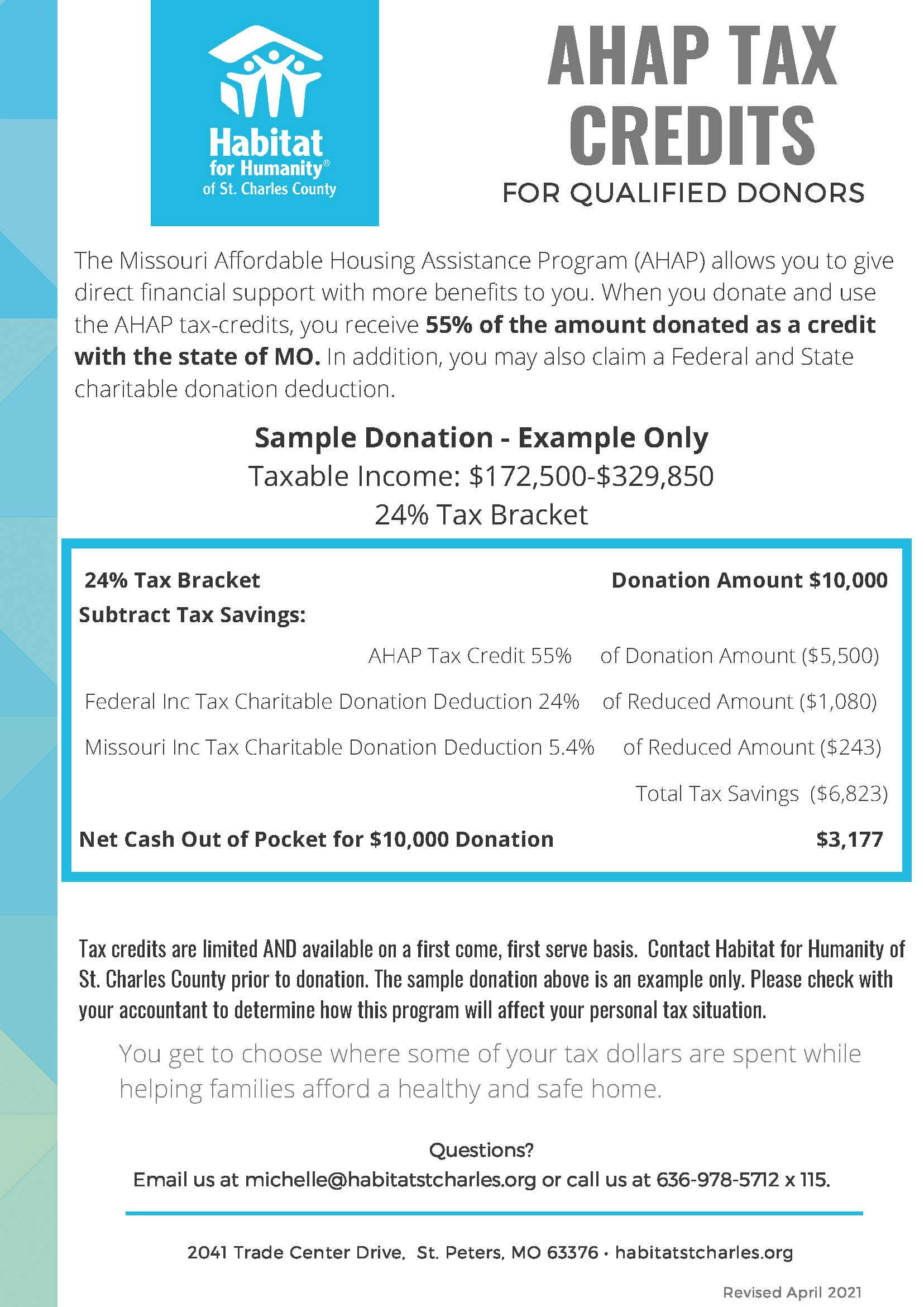

The Missouri AHAP tax credit is used as an incentive for a Missouri business and/or individual to participate in the production of affordable housing. This state tax credit is earned by an eligible donor for the donation of cash, equity, services, or real or personal property to HFHSCC, thereby assisting in our mission of building homes for hardworking, but needy families. The AHAP tax credit for an eligible donor equals 55 percent of the total value of the donation to HFHSCC.

Eligible Donor: To be eligible, a Donor must be subject to Missouri tax from business activities performed in the state of Missouri. More specifically, a Donor must be classified as one of the following: A corporation, a sole proprietorship, a farm operation, an individual reporting income from rental property or royalties, a small business corporation, a partnership, a bank, credit institution, savings and loan association, credit union, farmer’s cooperative credit association, or building and loan association, an insurance company, an individual partner in a partnership or shareholder in an S-Corporation or a public or private foundation.

For qualified donors, obtaining AHAP tax credits can be a simple as writing a check and completing a simple certification form.

Tax credits are limited. Available on a first come, first served basis. Note, please contact Habitat for Humanity St. Charles prior to donation.

If you have any questions, please contact:

Michelle Woods, Executive Director, at 636-978-5712 x 115 or email at michelle@habitatstcharles.org